About Reform

Our Story

Ohioans for Payday Loan Reform is a bipartisan, statewide coalition of clergy, social service agencies, organized labor, business leaders, veterans, and other local leaders who helped advocate for payday loan reform and protect Ohio families.

Before Reform

What was the situation in Ohio?

Approximately 12 million Americans annually use payday loans, often these are individuals with limited incomes and challenging credit histories. These loans, averaging $375 nationally, trap borrowers in a cycle of debt due to how loan repayments cut into a substantial portion of borrowers’ paychecks. With 40 percent of U.S. adults unable to handle an unexpected $400 expense without borrowing or selling possessions, this national crisis underscores the urgency for reform in payday lending practices.

In 2008, state lawmakers passed a crackdown on payday loan businesses and voters upheld the law later that year by referendum. But nearly a decade later, lenders had exploited loopholes in the law to operate with few restrictions. In 2018, 1 in 10 Ohioans took out a payday loan from among the more than 650 quick-cash lenders operating here – and were charged interest rates up to 591%, the highest in the nation.

A bill to cap payday lending rates was proposed in 2017 but only had two hearings. Then, in 2018, the Ohioans for Payday Loan Reform, a group of advocates and faith leaders, mobilized to cap interest rates at 28%. This joint effort led to the passage of legislation, the Ohio Fairness in Lending Act (2018) aka House Bill 123, aimed at reforming payday lending practices in Ohio.

The Ohio Fairness in Lending Act (2018) brought about positive change, emphasizing provisions for affordable payments, reasonable repayment periods, and capped interest rates. The law, effective since April 2019, is positioned as a potential model for other states seeking to regulate the payday loan industry more effectively, promoting a balanced approach that ensures the well-being of both borrowers and lenders.

“This reform, and the resulting savings – which are considerable - is tantamount to a statewide economic development effort that involves no public money. Instead of out-of-state payday lenders fattening their profits on the backs of Ohio working people, a big piece of that money will now stay in Ohio and will help families here live better.”

Pastor Carl Ruby, Coalition Leader

Ohio Fairness in Lending Act (2018)

The Ohio Fairness in Lending Act (2018) imposed common sense restrictions on the payday lending industry, including:

Interest is capped at 28% and monthly service fees cannot exceed $30.

Sets 90+ days repayment terms, unless the payments are limited to 6% of a borrower’s gross income.

Borrowers cannot be charged more than 60% of the loan principal in interest or fees.

Loans cannot be greater than $1,000 and auto titles cannot be used as collateral for loans.

What this means for Ohioans:

Three years following the passage of bipartisan payday loan reform -- the Ohio Fairness in Lending Act (House Bill 123, 2018), Ohio consumers have widespread access to safer, more affordable small-dollar loans, Ohio Department of Commerce annual reporting for 2020, 2021 and 2022 shows.

The landmark legislation has resulted in millions of dollars back in the pockets of consumers each year while preserving access to credit, just as Ohio lawmakers and advocates for reform intended. In 2022, the most recent year of data reporting, lenders extended $138 million in credit to a over 100,000 borrowers.

What’s the Payday Loan situation around the country?

As demonstrated in the graphic, the majority of states do not have reformed systems for payday loans. The lack of safeguards ultimately means that consumers do not easily have access to safe small-dollar lending. We can see that states that have reformed the system have the lowest average costs. And this, in effect, puts more money back in the consumers’ pockets instad of predatory lendors.

Read Ohio’s Commerce Reports to learn more

The Ohio Fairness in Lending Act requires the Ohio Department of Commerce to collect data from lenders making short-term loans. Data is reported annually in the “Short Term Loans” section and includes information on the number of borrowers, average loan size, average charges per loan, and average APR.

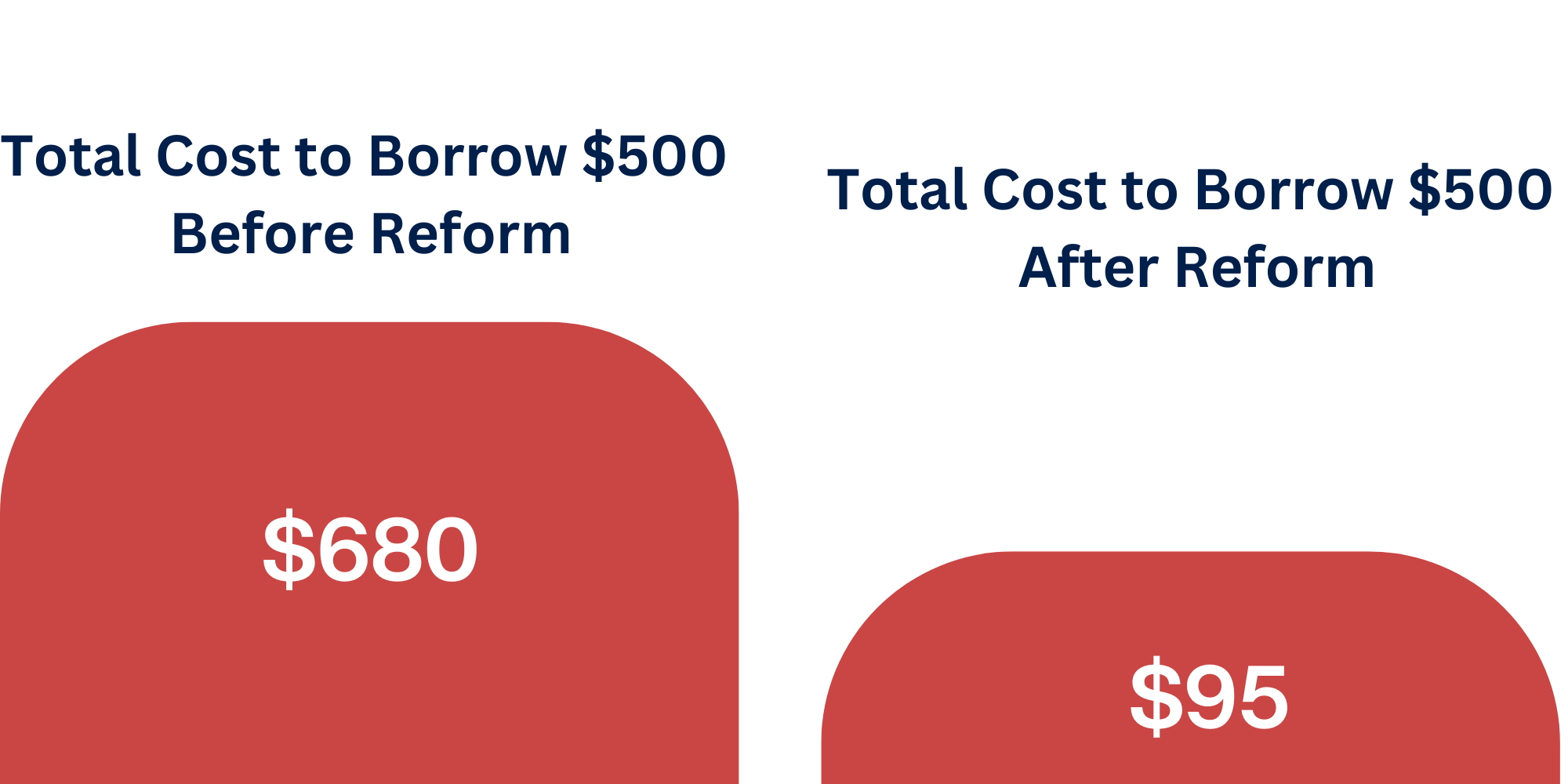

According to the Ohio Commerce Report, the average loan made under Ohio’s short-term loan act is $403. Before reform, it cost over $600 in fees to borrow $400. After reform, the average loan costs just $112. While opponents of reform claimed the new law would limit access to credit, after reform, we see licensed lenders issuing a quarter million loans annually. The success of the law was hailed by lawmakers, coalition leaders, and members of the business community from across the state.