Ohioans for Payday Loan Reform

With the passage of the bipartisan Ohio Fairness in Lending Act, Ohio consumers have widespread access to safer, more affordable small-dollar loans. This landmark legislation catapulted Ohio to the top as a national model for loan reform and a champion for consumer protection.

Since its full enactment in April 2019, the Ohio Fairness in Lending Act has saved Ohioans over $300 million in predatory fees and interest charges. On average, Ohio borrowers saved $585.

Prior to reform, Ohio had the most predatory payday loans in the nation. Now the state has some of the strongest consumer protections and lowest prices in the US. Ohio’s law is pointed to as a national model and bipartisan lawmakers in Virginia and Hawaii have already followed Ohio’s lead.

Before Reform

-

If a borrower took out a $300 payday loan in Ohio and paid it back over 5 months, they would end up spending $680 in interest and fees – a 580% annual percentage rate (APR).

Most payday loan borrowers used loans repeatedly, with the national average of 5 months. In Ohio, 83% of loans were taken out within 2 weeks of the previous loan.

Prior to reform, lenders were able to skirt consumer protections in lending statutes.

-

Before the Ohio Fairness in Lending Act, borrowers would regularly pay more than $400 in interest and fees to borrow exactly the same amount for three months.

After Reform

-

The Ohio Fairness in Lending Act imposed common sense restrictions on the payday lending industry, including:

Interest is capped at 28% and monthly service fees cannot exceed $30.

Sets 90+ days repayment terms, unless the payments are limited to 6% of a borrower’s gross income.

Borrowers cannot be charged more than 60% of the loan principal in interest or fees.

Loans cannot be greater than $1,000 and auto titles cannot be used as collateral for loans.

-

Good news! Payday loan reform works! Consumers are still able to access credit without predatory interest rates. You can see data from the Ohio Department of Commerce, whose reports can be found under our “About Reform” tab.

-

After the passage of the Ohio Fairness in Lending Act, borrowers cannot pay more than $108 in interest and fees on a $400, three-month loan.

Voices from the Statehouse

-

"We needed strong but flexible safeguards and HB123 delivered. Our law resulted in affordable payments, lower prices and a reasonable time to repay. Ultimately, the facts show we succeeded in striking a balance between making credit safer and accommodating responsible lenders.”

Former Rep. Kyle Koehler, R-Springfield

-

“Reforming payday lending has been a major bipartisan win for our state. Ohioans now have much stronger protections when they borrow. Workers and families can keep hundreds of their hard-earned dollars in their pockets, instead of having their hard-earned money siphoned out of their local economy.”

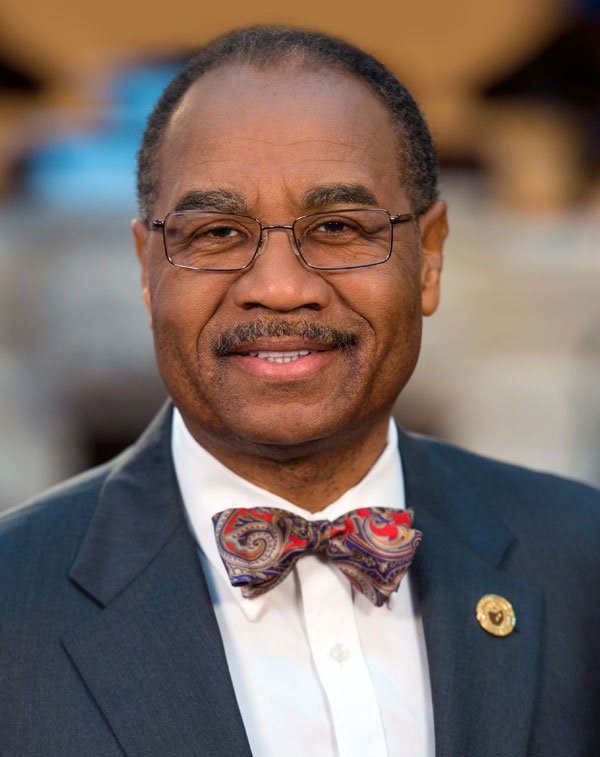

Sen. Vernon Sykes, D-Akron

-

“This reform, and the resulting savings – which are considerable - is tantamount to a statewide economic development effort that involves no public money. Instead of out-of-state payday lenders fattening their profits on the backs of Ohio working people, a big piece of that money will now stay in Ohio and will help families here live better.”

Pastor Carl Ruby, Coalition Leader